1) How can factoring help me?

If you make a lot of deferred payment sales and lack cash to fund your purchases, factoring is a solution to the problem. If you have problems with payment discipline of your customers, we recommend regression free factoring. In such case a factoring company backs (e.g. guarantees) payment collection from customers.

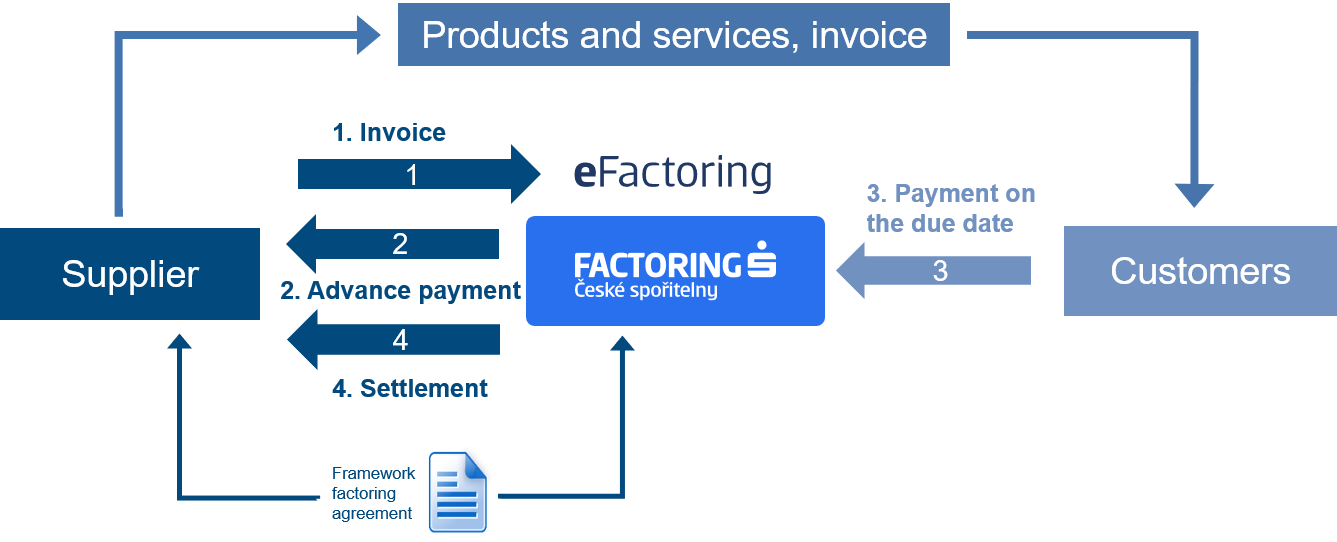

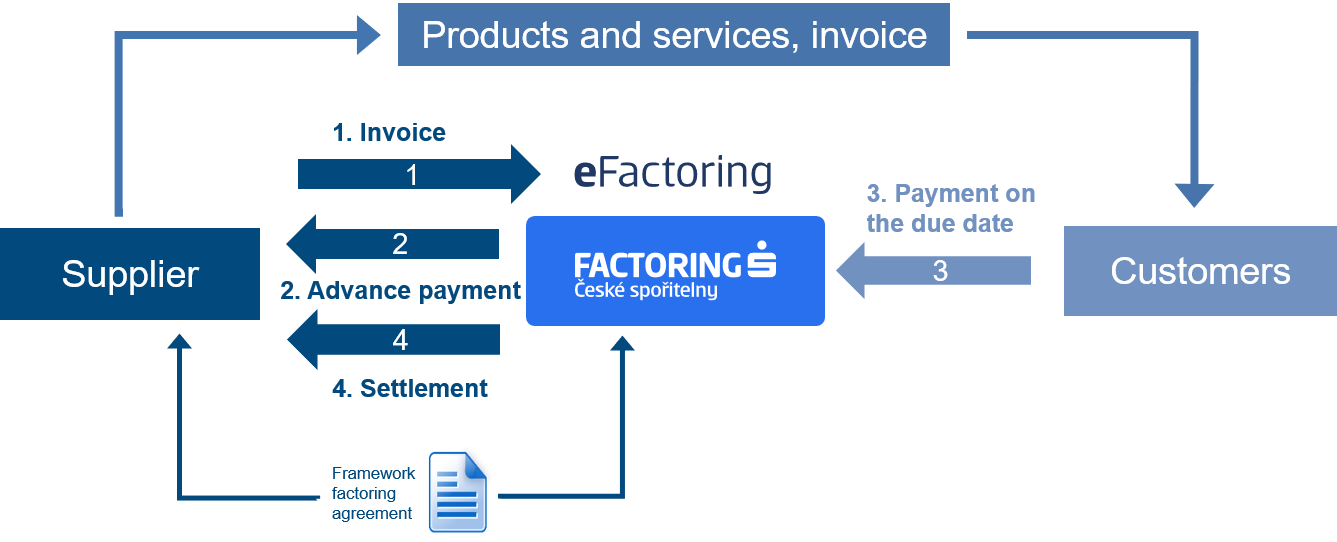

2) How does classical factoring work?

After entering an agreement with Factoring of Ceska sporitelna Bank you continue to invoice your products or services to customers. There is an assignment clause on your invoice (information on receivable assignment and payment transfer to our account). You send a copy with other necessary documents to our company and we will pay you an advance payment. Normally the advance is up to 90% of invoice nominal value. On a due date your customer pays the invoiced amount to our account and we pay you the outstanding 10 % of invoice nominal value. In case of export factoring, a correspondent factoring company in the country of your customer interferes to back and collect the payments.

How does domestic factoring work?

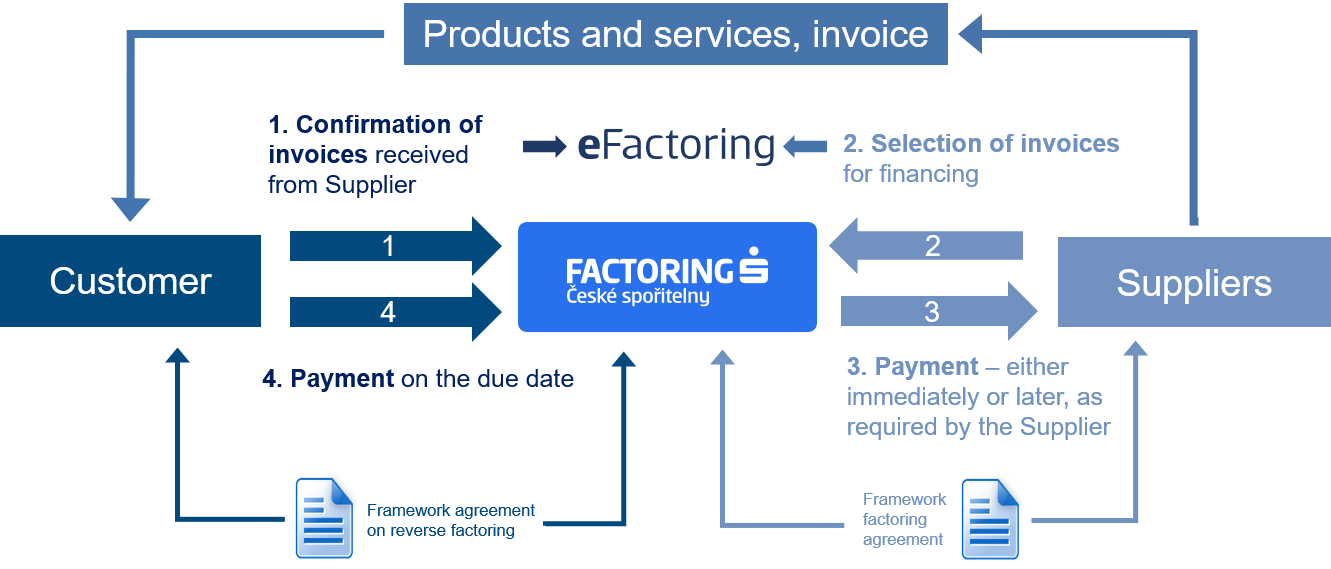

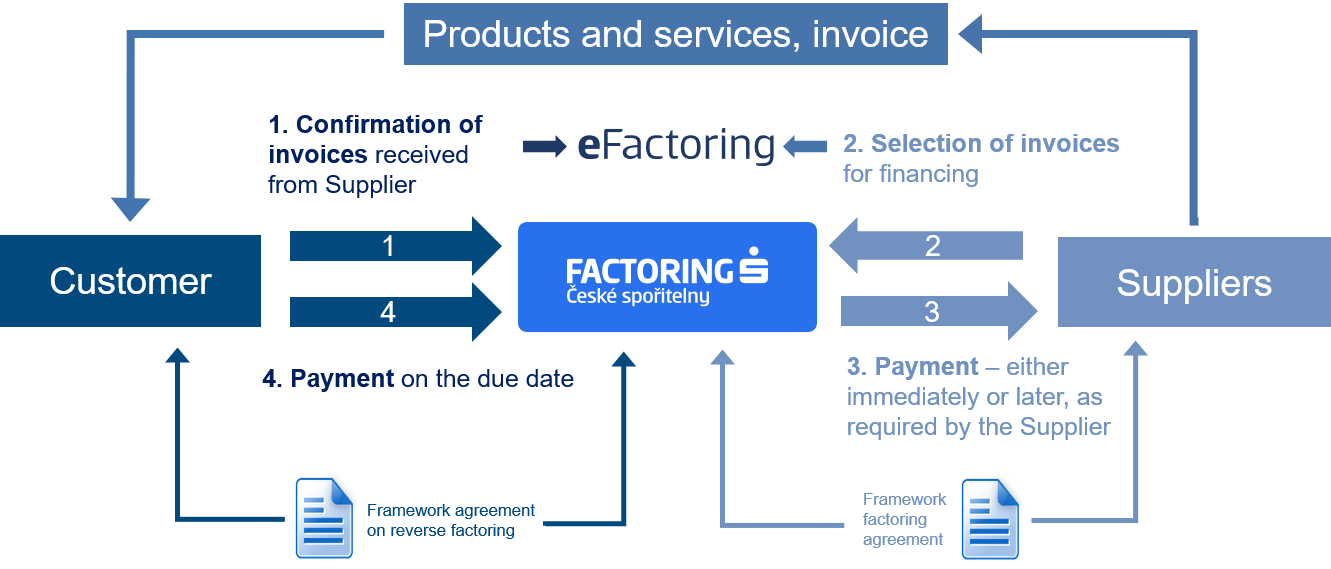

3) What is the difference between classical and reverse factoring?

Reverse factoring is a Supply Chain Finance technique that supports business cooperation among the companies of different size or financial strength. Whereas in the case of conventional factoring the client – supplier assigns his receivables against his customers, and in return he obtains immediate financing of his invoices, in the case of reverse factoring, it is one large creditworthy company initiating financing towards a number of smaller suppliers.

How does reverse factoring work?

4) What makes ediFactoring more efficient?

If you are using an EDI solution from EDITEL for electronic document interchange between you and your customers or suppliers, do not hesitate to approach us with a request for an offer of factoring financing. Electronic data interchange between you and us will help reduce your administrative burdens and accelerate the provision of financing to your company.

5) Is it possible to assign receivables electronically?

Thanks to the eFactoring application you can assign your receivables electronically using a digital signature.

6) What is your advantage in comparison with standard loans?

The first difference is time that we need to start funding your needs. Secondly, factoring in not only funding - it is an extensive service, comprising receivable indemnification if your customer fails to pay, receivable collection and management. You need not go to a bank, insurance company, collection agency and law firm separately.

7) How much do I really pay?

Your costs depend on a range of required services. Basically your costs consist of 2 items:

- factoring fee

- interest rate - equals 1M PRIBOR + x % p.a.

EXAMPLE:

Invoiced amount: 100 000 CZK

Due date: 60 days

Factoring fee: 0.35%

Funding interest: 1M PRIBOR + 2.0% p.a. = 2,6% p.a.)

Advance payment amount: 90%

1st day Supplier issues an invoice and sends it to a factoring company with a delivery note.

2nd day The factoring company calculates the advance payment amount and pays a supplier

100 000 x 90 % = 90 000,- CZK.

61st day Your customer pays a factoring company 100 000 CZK.

The factoring company pays the supplier 10 000 CZK and calculates the factoring fee (100 000 CZK x 0.35% = 350 CZK) and funding interest (90 000 CZK x 60/365 x 2,6 % = 385 CZK)

So the factoring company will charge you a total of 350 + 385 = 735 CZK.

This means that overall factoring service cost is 0,7% of receivable nominal value.

8) What must I do if I want to apply for factoring?

The first step usually consists of providing basic data on your company and customers. You can find a form called "Preliminary interest in factoring" in Download section. All you need to do next is contacting your regional sales representative and set up a personal meeting with him. During the meeting you will be explained factoring principles, we will answer your questions and prepare a solution tailored to your needs.

9) We are a construction company and are interested in factoring.

Unfortunately construction business, as well as complete industrial plant production or job-order production are not eligible for factoring services. The reason is specificity of those industries. Factoring services cannot be used in connection with work contracts, high set offs or payment retentions.

10) What is a definition of an ideal factoring client?

They are expanding companies providing goods or services to more customers with invoices due between 30 and 90 days. Potential set offs should not exceed 10% of receivable amount and there must not be a third party priority on receivables. One customer should not have more than 50% share in total company revenues. Other important conditions to be eligible for factoring services are longer company history and good financial position.

11) How fast can we start making the best of factoring services?

After evaluation of your clients, which usually takes one week, we will give you our quotation. If you agree with the terms, we will ask you for other economy information on your company, which takes one more week. When factoring cooperation is validated, you can start exploiting factoring services, e.g. two weeks after submission of list of customers (Preliminary interest in factoring).

12) When will I get money on my account?

Factoring of Ceska sporitelna Bank guarantees payment within 2 days. If you have an account in the Ceska sporitelna Bank, the transfer is immediate.

13) How often will you inform me about receivable status?

Thanks to eFactoring service you can check status of your receivables and advance payments on-line, through the Internet, anywhere and anytime. We can of course send you standard and special statements by post.

14) We are an export company and are interested in receivable securing.

As we are members of the biggest association of factoring companies in the world, we can provide you with regression free factoring (funding + securing) under above standard conditions. If your foreign customer does not pay we guarantee a payment of the invoice nominal value total - 80% advance payment immediately and outstanding balance of 20% on 90th day after invoice due date.