- Products

- About factoring

- News

- 19.5.2024 - Cenu Factoringu České spořitelny vyhrála klisna CARAVELLE ARDENTE

- 9.5.2024 - Výroční zpráva 2023

- 21.2.2024 - Odkup pohledávek loni dosáhl nového rekordu, firmy v náročném období stále častěji sázejí na jistotu uhrazených faktur

- 14.11.2023 - Do představenstva Factoringu České spořitelny byl zvolen Aleš Strýček

- 25.8.2023 - Zájem o odkup pohledávek neupadá, objem factoringu v prvním pololetí 2023 v ČR překročil 140 miliard korun

- 3.6.2023 - Cenu Factoringu České spořitelny vyhrál ryzák Bunamboo

- 19.5.2023 - Výroční zpráva 2022

- 18.5.2023 - Factoring České spořitelny získal ocenění Czech Superbrands Award 2023

- 12.5.2023 - Evropský factoringový trh rostl loni o necelou pětinu, pomaleji než v ČR

- 8.6.2022 - Factoring České spořitelny daroval 500 tisíc korun na psychologickou pomoc ukrajinským školákům

- 4.6.2022 - 70. Velkou červnovou cenu Factoringu České spořitelny vyhrál hnědák Agadir Gold

- 25.5.2022 - Annual Report 2021

- 4.1.2022 - Rozhovor s Jaroslavem Krutilkem, generálním tajemníkem ČLFA

- 10.10.2021 - Factoring je vhodný pro financování běžného provozu firmy

- 21.9.2021 - Firmy začaly více využívat factoring, který kryje riziko nesplácení faktur

- 6.9.2021 - 76. St. Leger Factoringu České spořitelny vyhrál favorizovaný hřebec Kamssio

- 31.8.2021 - Karel Nováček obhájil pozici místopředsedy představenstva ČLFA

- 26.5.2021 - Annual Report 2020

- 28.5.2020 - Annual Report 2019

- 31.5.2019 - Annual Report 2018

- 3.5.2019 - Karel Nováček byl zvolen předsedou AFS a místopředsedou ČLFA

- 8.4.2019 - 61. Velkou dubnovou cenu Factoringu České spořitelny vyhrál Black Canyon

- 18.3.2019 - Factoring České spořitelny získal ocenění Czech Superbrands Award 2019

- 8.2.2019 - Factoring České spořitelny se přestěhoval

- 23.7.2018 - Pavel Chlumský: Nabízíme řešení hlavolamu, který trápí všechny firmy

- 10.7.2018 - V době digitální se na peníze nečeká

- 30.6.2018 - Annual Report 2017

- 25.5.2018 - Principles of processing of personal data in a company Factoring České spořitelny, a.s.

- 22.1.2018 - Factoring České Spořitelny a EDITEL CZ spouští společný projekt ediFactoring

- Archive

- FAQ

- How can factoring help me?

- How does factoring work?

- What is the difference between traditional and reverse factoring?

- What makes ediFactoring more efficient?

- Is it possible to assign receivables electronically?

- What is your advantage in comparison with standard loans?

- How much do I really pay?

- What must I do if I want to apply for factoring?

- We are a construction company and are interested in factoring.

- What is a definition of an ideal factoring client?

- How fast can we start making the best of factoring services?

- When will I get money on my account?

- How often will you inform me about receivable status?

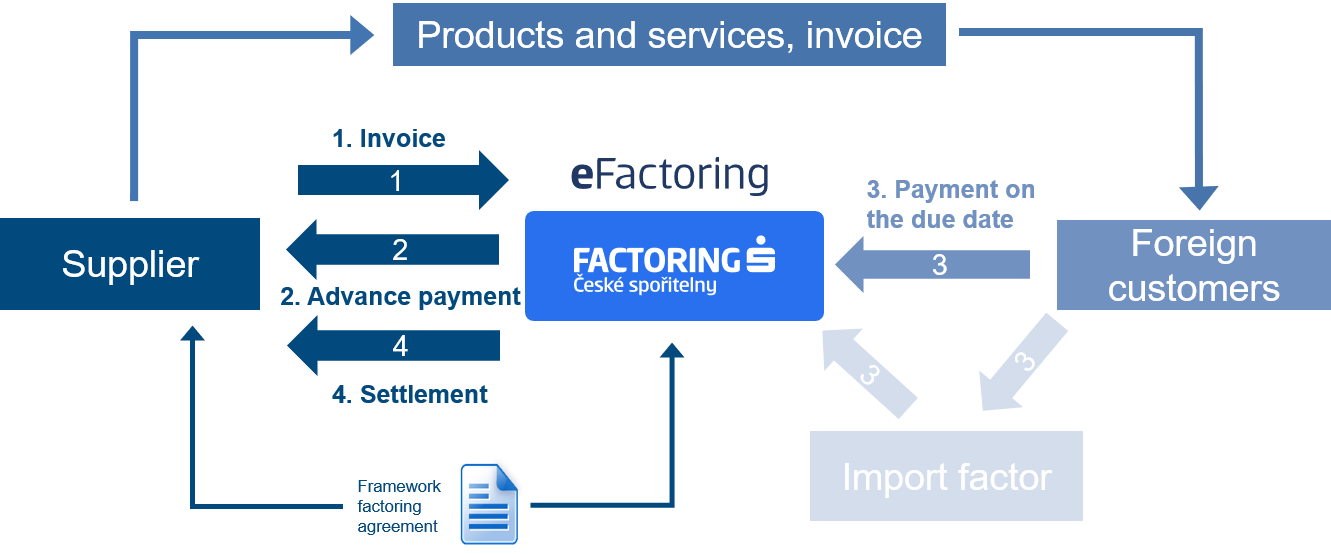

- We are an export company and are interested in receivable securing.

- About us

- Downloads

- Contact